Domestic Content is a hot topic in the solar industry. The Inflation Reduction Act (IRA) of 2022, in addition to extending the 30% Investment Tax Credit (ITC) through 2032, introduced a variety of other mechanisms to incentivize the installation of solar energy systems.

One of these mechanisms was an additional 10% bonus tax credit to the 30% ITC for utilizing materials manufactured in the United States. In the two years since being signed into law, the rule making bodies, led by the Departments of Energy and Treasury, have begun to define and codify how to achieve compliance. On May 15, 2024, the IRS released additional draft guidance to manufacturers to understand how they can qualify their products. This recently-released additional draft guidance makes it easier to qualify solar PV projects — especially residential projects — for eligibility for the Domestic Content bonus tax credit.

What We Know:

- Projects must use a combination of modules, MLPE and racking with a minimum aggregate Domestic Content of 40%.

- 40% can be achieved with considered selection of microinverters and IronRidge Racking.

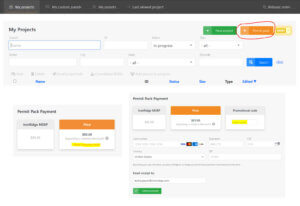

- IronRidge has domestic content capabilities to support commercial asset owners and financiers of third-party-owned residential systems (financed by leases or PPAs).

- Projects must be placed in service in 2024 to qualify using the 40% minimum Domestic Content hurdle.

What You Need to Know:

- Homeowners and Contractors are not eligible to capture the 10% domestic content adder.

- Commercial Asset Owners and financiers of third-party-owned residential systems (financed through leases or PPAs) can capture the adder and will require domestic content to qualify.

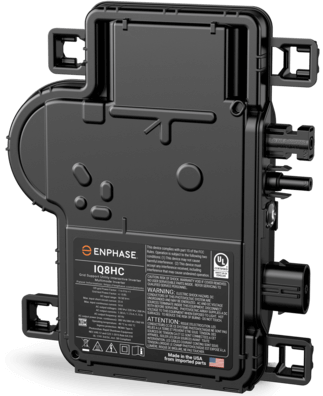

- We are working with Enphase and others to meet the 40% designation as a microinverter/rail package. Under the recently-released guidance, IronRidge rails that are manufactured in the US contribute nearly 9 points toward reaching 40% domestic content minimums. Enphase’s domestically-produced MLPE or other domestically produced products can supplement that, clearing the 40% hurdle.

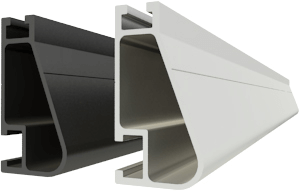

- The BX system is currently manufactured in the US and can contribute meaningfully to reaching the 40% Domestic Content minimum for C&( projects. Projects using our BX solution can qualify for the ITC Domestic Content bonus credit through the IRS guidance that was issued in May, 2023. Each project must qualify on its own merits; we are currently supporting project owners in making these determinations.

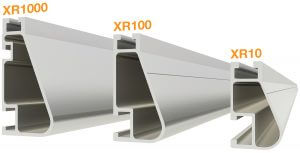

Our Domestic SKUs

- XR-10-168M-US

- XR-10-168B-US

- XR-100-168M-US

- XR-100-168B-US

What’s Next?

Experts with SEIA, Enstall and other interested parties have been sorting through the often-confusing details. There’s lots of misinformation, as well as disinformation, out there. While written comment is still being sought by the government until July 15th, and further definition will follow, we can give guidance based on current facts.

IronRidge sources material through a global, diversified supply chain. As part of our sourcing strategy, we have domestically sourced material for use by Commercial Asset Owners and TPO partners. A path to 40% is not achievable solely on the back of the strongest racking system in America. You need coordination and access to additional domestically-sourced content to meet the 40% threshold. Enphase, with their domestic version of their IQ8, and other domestically-produced MLPE paired with XR rail is the preferred choice to meet this 40% target.

What is the Inflation Reduction Act (IRA)?

The Inflation Reduction Act (IRA) is legislation passed by the U.S. Congress and signed into law by President Joe Biden on August 16, 2022. This act has provisions aimed at addressing climate change. The IRA includes substantial funding to support renewable energy projects, such as wind, solar, and battery storage. This is intended to accelerate the transition to a cleaner energy grid.

What is the Investment Tax Credit (ITC)?

The (ITC) is a federal tax credit that incentivizes the installation of solar energy systems, and is set at 30% for residential and some commercial systems installed between 2022 and 2032. It decreases to 26% for systems installed in 2033 and 22% for systems installed in 2034. After 2034, the credit is set to expire unless renewed by Congress.

Are there additional Tax Incentives for solar in the IRA?

The IRA contains provision for additional tax incentives for projects located in areas affected by the closure of coal mines, coal-fired power plants, or that have significant employment related to the fossil fuel industry, that occur and service low-income communities, and/or that satisfy prevailing wage and apprenticeship requirements, may be eligible for additional credits. These credits are additive. For more information on the ITC please reference this informative article from the Solar Energy Industries Association: Solar Investment Tax Credit (ITC) | SEIA

Be sure to consult a tax professional. IronRidge’s statements, and the decisions IronRidge makes on this matter, are based on federal documentation and information available in the Federal Register.